The Mindset You Need Before Buying a Home in Cebu

- cebuhousefinder

- Jun 25, 2019

- 3 min read

Updated: Aug 14, 2025

Buying a home in Cebu is exciting—but it can also be overwhelming. Many buyers rush into viewings and contracts without first preparing their mindset. The truth is, a clear head and strong plan will save you from stress and costly regrets. Whether you want a condo in Cebu City or a house in Mactan, your approach can make all the difference. This guide will help you set the right mindset so your homebuying journey is confident, stress-free, and rewarding.

Step 1: Ask Yourself—Am I Ready to Own a Home in Cebu?

Owning a home in Cebu means stability, belonging, and building wealth over time. But it also means committing a large share of your income for years. Ask yourself:

Is my income stable?

Am I ready to stay in Cebu long-term?

Do I want to invest in a growing market?

Cebu offers strong economic growth and island charm. From IT Park condos to Talisay subdivisions, there’s something for every lifestyle. But knowing you’re ready—mentally and financially—is the first step toward a wise purchase.

Related resource: For guidance on finding the right home fit, check out Guide: Find Your Dream Home in Cebu

Step 2: Balance Emotion with Practicality

It’s natural to get excited about a property. Picture waking up to a sea view in Mactan or enjoying the spacious garden of a Mandaue home. That spark matters—it means you’ve found something that fits your vision.

But emotions alone can lead to overspending or overlooking legal issues. Balance your feelings with practical steps:

Verify the property title.

Check the developer’s track record.

Compare prices in the area.

Must-Read: Add this to your checklist: How to Conduct Due Diligence When Buying Property: A Comprehensive Checklist.

PRO TIP: Don't let a "dream home" push you

into ignoring your budget or skipping due diligence.

Step 3: Understand Your Financing Options

Financing will shape your homebuying journey. Common choices include:

Bank Loan – Competitive rates but requires good credit.

Pag-IBIG Loan – Longer terms, ideal for affordable housing.

In-House Financing – Flexible terms but often higher interest.

Example: A pre-selling condo in Cebu Business Park may allow low monthly payments for 36 months before the lump sum balance. In contrast, a Talisay house-and-lot might work best with a Pag-IBIG loan.

Things to Remember:

Keep monthly payments within 20–30% of your income.

Factor in taxes, fees, and maintenance.

Have a reserve fund for unexpected costs.

Step 4: Avoid Buyer’s Remorse

In Cebu’s hot market, fear of missing out is common. New projects in Lapu-Lapu or Cebu Business Park can create pressure to decide fast. But buying in haste can lead to regret.

To avoid this:

Research before visiting properties.

Compare at least 3–5 options.

Trust your instincts—but verify the details.

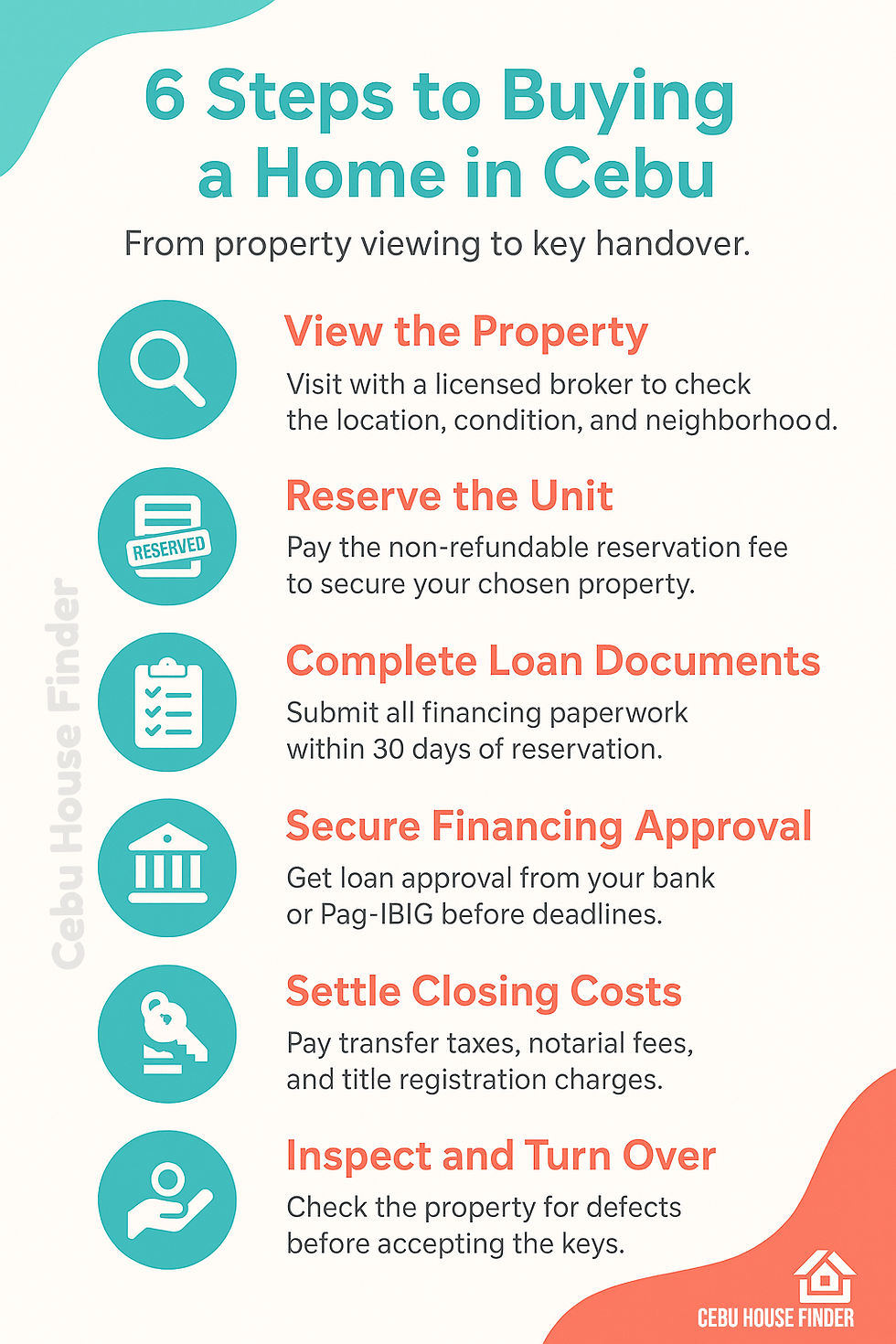

Step 5: Follow a Clear Buying Process

Here’s the typical flow for buying a home in Cebu:

Helpful link: For more detail on these steps, see Steps to Buying a House in Cebu: A Guide for First-Time Homebuyers.

Things to Avoid

Rushing into a deal without research.

Overstretching your budget.

Skipping legal checks on ownership and permits.

Things to Remember

Work only with licensed real estate brokers.

Keep both your head and heart involved.

Plan your finances before property hunting.

Conclusion

The right mindset is your strongest tool when buying a home in Cebu. By preparing yourself emotionally and financially, you’ll make decisions with confidence, avoid stress, and secure a home that’s both a personal dream and a smart investment.

Ready to buy your Cebu home? Call 0920 207 5035 or email cebuhousefinder@yahoo.com for expert help in finding the best condos, house-and-lot deals, and residential lots.

Comments